Early this spring, with federal officials scrambling to roll out coronavirus relief, Marc Rowan began working behind the scenes to sweeten the pot for his private equity company.

Rowan, the co-founder of the massive Apollo Global Management, urged the Federal Reserve to expand a key emergency program that helps high-finance outfits holding securities rated less than triple-A. That help, the billionaire added, ought to come with no strings. Any limits on executive pay at bailed-out firms, he observed, “would render the program unpalatable.”

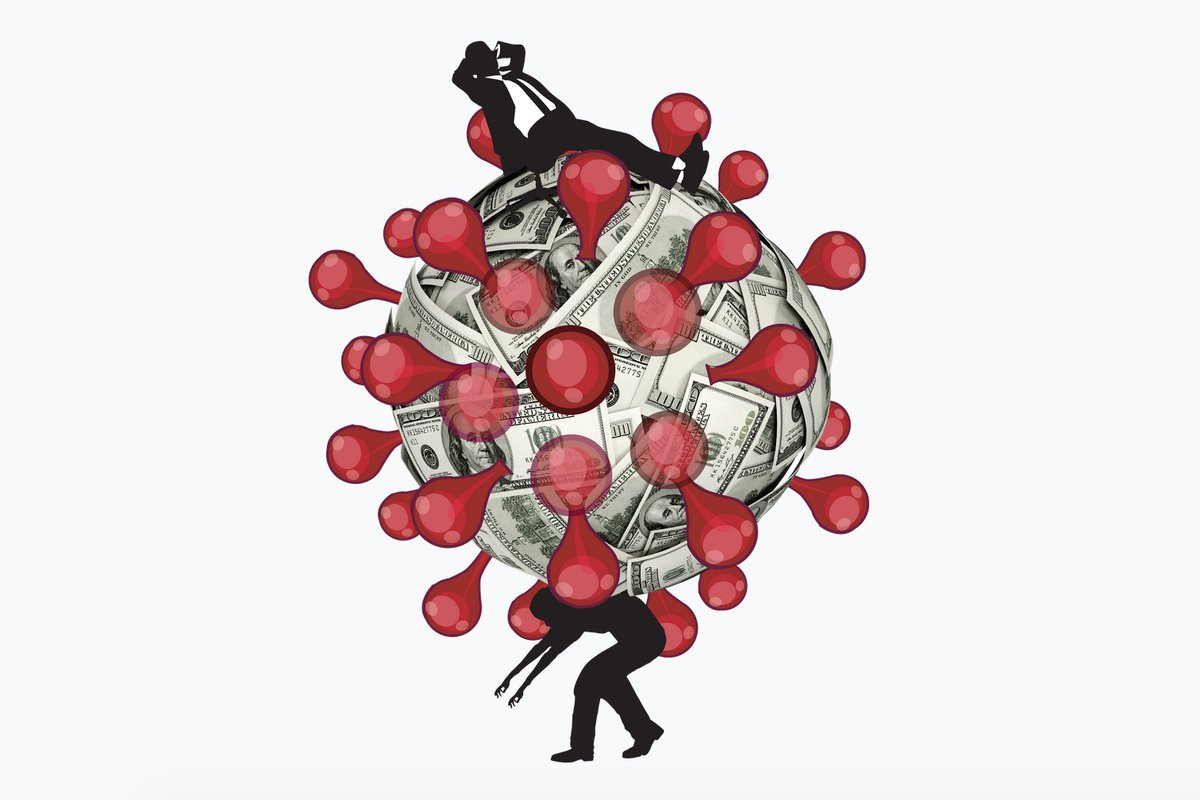

Life has seldom been “unpalatable” for America’s wealthiest people, even here in the throes of the COVID-19 pandemic. Our corporate and financial elites have now spent more than a generation amassing an enormously outsized share of the nation’s income and wealth. These elites have no interest in watching that outsized share shrivel.

Indeed, as historian Walter Scheidel reminds us, the rich have never shown much interest in becoming less rich. In centuries past, the Stanford scholar has detailed, societies have become appreciably more equal only when plagues and other social earthquakes knock the rich off balance.

The last time the United States experienced anything close to a cataclysmic social earthquake, the years of the Great Depression and World War II, the rich did lose their balance as average Americans mobilized to forge a more equal nation.

Will that history repeat itself as the current pandemic plays out? The odds don’t look good. Severe shocks these days, as activist and author Naomi Klein points out, have become springboards that help elites increase their wealth and power.

“Pretty much every company in America qualifies for a loan that can in some way be touched by the Fed. If you want to know why investors are so happy, it’s because they’re all getting bailed out.”

Today’s standard public health protocols for pandemics, unfortunately, serve to enhance growing inequality. Social distancing, sheltering in place, and other public health “good practices” advantage the affluent. Low-wage workers in jobs essential to keeping people fed or healthy can’t “shelter in place” or keep “social distance” on the buses they take to work.

In a perfect world, public policy would offset inequalities like these, and we have seen some steps in that direction.

The Families First Coronavirus Response Act signed March 18, for instance, gave workers at firms with fewer than 500 employees the right to up to eighty hours of coronavirus-related paid sick leave. Americans of modest means gained some additional support nine days later with the passage of the Coronavirus Aid, Relief, and Economic Security Act, known as the CARES Act, sweeping legislation that appropriated $1,200 for every adult earning up to $75,000 and added $600 to weekly state unemployment benefits.

The same legislation set aside $349 billion for a “Paycheck Protection Program” designed to help small businesses keep people on the job. The program promised “forgivable loans” to enterprises with fewer than 500 employees that kept their payrolls intact.

At first glance, workers and small businesses seemed the CARES Act’s clear winners. Of the $2.2 trillion in new spending authorized by this package, only $500 billion seemed earmarked to help big business. This included set-asides for America’s airlines and companies crucial to “national security,” a shorthand for Boeing.

In fact, the help the CARES Act provides overwhelmingly tilts to the top. The vehicle for that tilting? The Federal Reserve, America’s central bank.

The Fed has long had the authority, in certain situations, to buy up corporate debt. But, by law, the Fed cannot risk losing money on these transactions. The CARES Act eliminates that risk—by dedicating $454 billion to “backstop” potential Federal Reserve losses. Every dollar of backstop lets the Fed funnel ten dollars into Corporate America.

CARES Act-enabled support for America’s biggest businesses, in other words, could total $4.54 trillion, far more than ten times the assistance the act earmarks for small businesses, which employ about half the nation’s workers. Essentially, the CARES Act ensures that the coronavirus-relief effort’s biggest winners will be those who need a helping hand the least. Wall Street, once again, trumps Main Street.

Lawmakers looking out for the super-rich left nothing to chance in drafting the CARES Act. They buried in the 880-page legislation a variety of tax changes that leave the wealthy wealthier. The most lucrative of these changes will save Americans making at least $1 million a year an average of $1.6 million in 2020, more than 1,300 times the $1,200 due Americans making up to $75,000.

Those $1,200 checks didn’t start arriving in the bank accounts of economically insecure Americans until weeks after the legislation became law. Some checks, Congressional watchdogs believe, may not arrive for months. And many Trump officials are letting banks withhold from the $1,200 money for debts like the exorbitant fees banks routinely charge on overdrafts.

The beefed-up unemployment benefits have proven equally disappointing. Years of austerity cuts have left state offices understaffed and technologically adrift. In March, state computers crashed regularly as millions of suddenly jobless workers started applying for benefits. In early April, the news outlet VICE called all fifty state unemployment offices. They got through at only two.

Many newly jobless people seeking help have encountered unwelcome surprises. News stories covering the CARES Act’s passage had trumpeted the legislation as a victory for gig economy workers who, for the first time, would be eligible for unemployment benefits. But rideshare drivers who stopped driving because they felt sick and didn’t want to risk spreading disease discovered that they couldn’t qualify because a Trump Labor Department “guidance” had limited their eligibility. As of late April, only ten states were even processing gig worker unemployment benefit applications.

Small businesses have faced similar aggravations. The Trump Administration steered the processing of the new Paycheck Protection loans through commercial banks, and these banks—giants including JPMorgan Chase—gave their prime customers priority over mom-and-pops. And why not? A $10 million Paycheck Protection loan could return $100,000 in fees to banks—and take no more time to process than small loans that brought only $5,000.

In the Paycheck Protection Program’s first two weeks, banks collected $10 billion in fees for little more than passing completed loan applications to the Small Business Administration.

To make matters worse, sizable chunks of the aid meant for small businesses went to corporations that would fit no one’s definition of small. Some but not all of these payments have been returned.

Thanks to an obscure CARES Act provision, at least ninety-four corporations large enough to have their shares traded on Wall Street pocketed federal aid dollars in the Paycheck Protection Program’s first round of funding. One Dallas-based hotel group dropped its payroll from 7,000 to 500, then collected $59 million in federal support while distributing $10 million in dividends to its top shareholders.

The overwhelming majority of Americans working today won’t make $3 million in their entire lifetime. The typical American worker now makes less than $49,000 a year.

Some of the big “small” businesses that grabbed Paycheck Protection checks returned their federal money after disclosures about those dollars ignited a national uproar. But three-quarters of the nation’s real small businesses had still not received, six weeks into the lockdown, any federal help.

In April, a grassroots campaign launched by angry small business owners asked Congress for $1 trillion in new Paycheck Protection support, with half of that earmarked for enterprises with fifty employees or less. The legislation finally approved on April 23 advanced only $310 billion and included no explicit set-aside for mom-and-pops, only $60 billion for distribution by small lenders like credit unions and community banks.

Massive numbers of small business failures now seem practically certain, and that prospect has America’s most predatory “financial engineers” almost giddy.

After the 2008 financial collapse, hedge funds and private equity firms helped buy up $36 billion worth of foreclosed residential homes, then created huge new corporate landlord companies to manage their fledgling rental empires. The coronavirus crash may now generate a similar concentration. Private equity firms are sitting on $1.5 trillion in cash, CNBC reports, “a record pile of ‘dry powder’ for deals.”

But most pandemic-era wheeling and dealing will likely continue to revolve around the Federal Reserve. The Fed is now buying up everything from student loan-backed securities to commercial real estate mortgages. Corporations now even have Fed buyers for their high-risk junk bonds.

“In other words, pretty much every company in America qualifies for a loan that can in some way be touched by the Fed,” observes American Prospect Executive Editor David Dayen, an astute daily chronicler of all things coronavirus-related. “If you want to know why investors are so happy, it’s because they’re all getting bailed out.”

The Fed’s dedication to keeping high rollers happy has become so pronounced that even the infamously conservative Wall Street Journal editorial board has taken notice. The Fed, says the paper, “is protecting Wall Street first” and hoping the resulting wealth “filters down.”

But no sign of that filtering has yet surfaced, and we have no reason so far to believe that wealth in America—or good health, for that matter—will end up more equally shared once the COVID-19 dust settles. All the suffering has so far been flagrantly unequal.

New York City, home to the nation’s most deadly COVID-19 outbreak, offers one vivid yardstick of that suffering. In the five New York zip codes with the highest positive coronavirus test rates, per capita incomes range from $17,000 to $35,000. The income range in the five zip codes with the lowest positive tests: $106,000 to nearly $148,000. Those hurting the most: minority and immigrant communities.

Amid the death and despair, America’s richest are counting on grand philanthropic gestures to work their normal legitimizing magic.

On April 1, Jeff Bezos, the richest man on Earth, donated $100 million—about eleven days of his income—for COVID-19 anti-hunger relief. That charitable splash came less than two weeks after four U.S. Senators sent Bezos a letter blasting Amazon, the source of his fortune, for setting “efficiency and profits over the safety and well-being of its workforce.”

The cracks in America’s economic order have simply stretched too wide to be papered over with philanthropy. How can progressives now speed our pandemic recovery while also undoing the intense concentration of wealth and power that’s left us so ill-equipped to confront this crisis?

Ideas for moving on both these fronts are now bubbling up from progressive activist groups and their allied policy wonks and politicians.

Some of these ideas build on the newly widespread public recognition that the men and women who keep America running don’t sit in corporate executive suites—and don’t get valued nearly as much as they should. Senator Bernie Sanders is calling for $500 a week in added “hazard pay” for workers at the economy’s essential front lines, and Senator Elizabeth Warren and Representative Ro Khanna are urging “robust premium compensation” as part of a new “Essential Workers Bill of Rights.”

Meanwhile, People’s Action and a host of other advocacy groups are backing a bill from Representative Ilhan Omar that would cancel rent and home mortgage payments for as long as the pandemic lasts. Under Omar’s Rent and Mortgage Cancellation Act, landlords would get dollars to cover their losses, but only by agreeing to freezing rents for five years and transferring to their tenants 10 percent of their rental property equity, among other terms.

Other proposals link recovery to climate change. The Democracy Collaborative and Oil Change International have advanced a provocative proposal to take public control of now distressed oil, gas, and coal industries, with an eye toward winding them down while providing workers economic security and avoiding “a bailout for fossil fuel executives.”

Another progressive thrust speaks directly to the distributional fiasco with the CARES Act’s $1,200 checks. Every American, the Great Democracy Initiative has proposed, ought to have a personal account with the Federal Reserve. These free accounts would give individual Americans the same higher than normal interest rates and instantaneous access to their money that the Fed’s current account holders—America’s banks—enjoy.

With this account expansion, any future stimulus checks Americans need would simply appear in their individual Fed accounts, accessible through their local post offices. This could become the hub of a new public banking system—and help save the U.S. Postal Service from the privatization the Trump Administration wants to inflict upon it. Senator Sherrod Brown and Representative Rashida Tlaib have introduced legislation that begins to build toward a people-focused Fed.

Representative Pramila Jayapal, co-chair of the Congressional Progressive Caucus, has concentrated on making sure Americans have more income to deposit. Her proposed new Paycheck Guarantee Act would cover at least three months of base payroll costs—up to $100,000 per employee—for all workers who’ve taken a coronavirus hit.

Businesses that qualify would have to agree not to buy back their own shares of stock, shell out dividends to shareholders, or pay out executive bonuses for three years.

None of these strings currently apply to any of the trillions the Federal Reserve is busy bestowing upon the nation’s biggest banks and corporations. The strings that do apply in the CARES Act’s bailouts for airlines cut the companies plenty of slack. Executives at these enterprises who collected more than $3 million last year can continue to collect the first $3 million of that pay, plus half of whatever else they made in 2019.

The overwhelming majority of Americans working today won’t make $3 million in their entire lifetime. The typical American worker now makes less than $49,000 a year.

In a deeply unequal America, our democracy clearly has a problem legislating emergency relief without further enriching the already rich. House Democrats made a move to reverse that pattern in March, drafting legislation—subsequently shelved in favor of the Senate’s CARES Act—that would have barred corporations that pay their top executives more than fifty times their typical worker pay from receiving federal bailout relief.

In 2018, fifty American corporate CEOs took home more than 1,000 times what their typical workers earned.

The House attempt to limit executive pay at bailed-out firms to a fifty-times differential raises deeper questions. Why should our tax dollars go to any corporations that pay executives excessively? Why should such companies be eligible for government contracts or tax breaks or subsidies of any sort? Why should we be rewarding corporations that make our inequality worse?

That inequality matters more than ever in our coronavirus epoch. The wealthy are already underwriting a faux grassroots movement to “liberate” America from coronavirus lockdowns. The affluent will, of course, largely dodge whatever infectious fallout results from any premature liberation. They can continue sheltering in place. Millions of working Americans, in contrast, will have no choice as shutdowns lift. They’ll have to risk their lives to put bread on their tables.

To be truly safer, we need to be truly equal.

Sam Pizzigati | Radio Free (2020-06-03T17:12:38+00:00) The Corona Class War. Retrieved from https://www.radiofree.org/2020/06/03/the-corona-class-war/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.