However, the EIB has gained a reputation for financing huge infrastructure projects (see former Juncker Plan) and pushing for the privatization of public services, like health, transport, and energy, through promoting public-private partnerships. So we might expect that SMEs will not necessarily be the ones to profit from the EIB coronavirus emergency money.

Which corporations are benefiting from the EIB’s COVID-19 emergency programs?

In accordance with its policy, the EIB only provides detailed information on the corporations selected if the project promoter has not presented legal objections for its confidentiality. With the information provided, however, the list of projects financed since the announcement of the EIB emergency package the on 16th March 2020, gives us an idea of what sectors our money goes to: since the start of the pandemic the EIB approved and signed 30 projects for credit lines for banks, 16 projects for the energy sector, 12 for transport but only 4 for health projects.

Under its COVID-19 recovery plans, the majority of EIB operations will be intermediated, meaning that the EIB will provide credit lines or guarantees to other financial institutions (commercial banks or national public banks). In these cases, the EIB is delegating the decision on which companies access the loans and guarantee programs to the intermediary banks without strong and binding social, environmental and climate criteria. That means an entity like a commercial private bank, out of public reach, decides on its own criteria, which companies get public support and which do not.

Are we rescuing corporations?

First of all, ’rescue’ means that the company, without public support, would probably go bankrupt. If people and SMEs can go bankrupt, why not let down the big polluters in our economy? Because rescuing the big corporations means in reality rescuing the shareholders. And in many cases, the shareholders of the huge corporations are powerful banks and investment funds, such as the US fund BlackRock. This fund is the world’s largest investor in fossil fuels, involved in the arms industry and has surprisingly become the new advisor to the European Commission on Environmental, Social and Governance (ESG) issues for the banking supervision process.

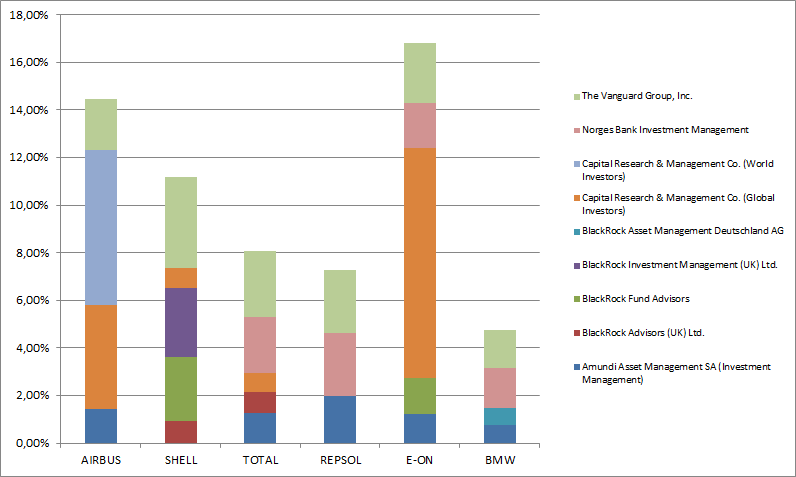

In fact, of the EU’s 6 polluters (Repsol, Shell, Total Capital, E.ON, Airbus and BMW), Black Rock is a shareholder in 4 of them, as are the Norwegian Norges Bank Investment Management and the US investment fund Capital Research & Management Co. (Global Investors). The French asset management company, Amundi Asset Management SA (Investment Management), holds shares in 5 of these corporations and the US investment fund, The Vanguard Group, in all of them. Of course, these global players are interested in receiving their share of the corporation’s benefits, despite the fact that the world is suffering a global pandemic.

Here’s another of many problems: dividends. Although the ECB has advised all entities under its supervision to compel banks not to pay dividends until October 2020, this obligation does not apply to companies which are receiving public funds. For our 6 polluters, this means they can keep paying dividends to their shareholders, while applying for public emergency funds. Indeed, Shell paid out dividends for the 4th quarter of 2019 amid the COVID emergency on 23 March and will pay out the next dividends on 22 June. The same goes for Total, paying the next dividends on 29 June, Repsol on 8 July, BMW on 19 May and E.ON on 28 May.

Nor should we forget that Chief Executive Officers (CEOs ) often possess an important amount of shares of a company and benefit directly from the proper functioning of the company and the distribution of dividends. For example, Antonio Brufau, President of Repsol, owns 566,803 shares. Ben van Beurden, the CEO of Shell, earned €1,3 million through dividend payments by Shell in the year 2017. In this way, CEOs can earn 100 to 300 times more than the average salary of the company. Therefore, there is a real risk of transferring public money, aimed at mitigating the effects of the pandemic, to investors’ pockets through the distribution of dividends.

Finally, another problem is that public emergency funds are going to corporations that have their subsidiaries in tax havens. France, Denmark and Poland have made a good start to push for restricting companies that keep large sums of money overseas in tax havens from accessing stimulus funds. The European institutions, like the ECB and the EIB, should follow this example and prohibit these corporations from benefitting from any public funds or aid. Indeed, according to the organization Tax Justice, Shell has 8 subsidiaries in Switzerland. According to Total’s Registration Document 2019, the company has 166 subsidiaries in tax havens, out of a total of 1191. And according to a recent Intermon Oxfam report, Repsol has 81 subsidiaries in tax havens. The same report indicates that since 2004 the total of Spanish corporation taxes has decreased 11% while corporation dividends have increased by 83%.

Towards a democratic, transparent and fair management of the crisis

The experience of managing the 2008 crisis is still very present. Unfortunately, the path taken by public institutions in 2020 is very similar. To guarantee democratic management of this current crisis, we must insist on transparency and disclosure of public financial aid mechanisms. European citizens should be able to discuss and know where the aid is directed to. Lacking information is only worsening the reputation of European institutions and their role in crisis management.

The European Parliament declared a climate emergency on 28 November 2019, but how are their statements reflected in the COVID-19 policies towards big polluting corporations? It is important to keep in mind the time dimension of the decisions being made right now. By committing to support big polluting corporations by buying their corporate debt, EU institutions will need to push for policies that enable these corporations to perform well for at least a decade more in order to get the money back. But this is totally incoherent with any policy to fight the climate emergency. In this sense, we need clear and binding environmental and social criteria, in order to stop big polluters profiting from public aid.

In addition, according to a leaked document from April 2020, the European Commission is preparing a proposal on restrictions of dividend distribution for corporations receiving public aid. Pending the details that determine the scope and effectiveness of the proposal, it is necessary to denounce and demand that there should be no distribution of dividends in times of crisis. The same goes for corporations with subsidiaries in tax havens: public money should not go to tax-evading companies but instead benefit the people that most need the money.

PrintAlfons Perez Nicola Scherer | Radio Free (2020-06-04T09:38:43+00:00) How big polluters are profiting from European public aid. Retrieved from https://www.radiofree.org/2020/06/04/how-big-polluters-are-profiting-from-european-public-aid/

Please log in to upload a file.

There are no updates yet.

Click the Upload button above to add an update.